Smart Money Targeting Ownership in Canada’s Apartment REIT Sector

GIC’s $2 billion bid to acquire InterRent may signal confidence in the Canadian apartment REIT sector and will likely have positive ripple effects on sector valuations.

Smart Money Targeting Ownership in Canada’s Apartment REIT Sector

When a group led by InterRent’s Executive Chair, Mike McGahan, partnered with Singapore’s sovereign wealth fund GIC in a bid to acquire the Canadian public apartment REIT for roughly $2 billion, it didn’t just make headlines—it sent a message. It not only reaffirmed confidence in the apartment sector, but it also came at a time of broader uncertainty around Canada’s economic outlook, job market, and shifting global trade dynamics. Yet, despite these challenges, it’s evident that large institutional capital sees opportunistic value in Canadian apartments—a positive sign for the entire sector.

Below, we break down the key takeaways of The Globe & Mail article and highlight its main insights on Why smart money is targeting cheap Canadian apartment REITs.

Canadian apartment REITs are generally considered undervalued

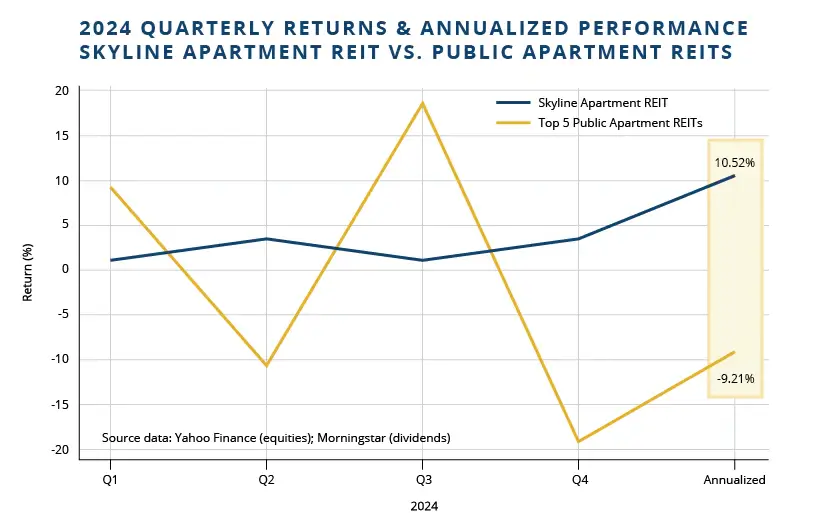

While Skyline Apartment REIT exceled and delivered a 10.52% return last year¹, the picture wasn’t as optimistic for our public apartment REIT peers. Collectively, the five largest publicly traded apartment REITs by market capitalization produced an average (non-market cap weighted) return of -9.21%. A key contributing factor was a Canadian government plan announced on October 24 to temporarily curb population growth, which dampened public market sentiment, and weighed heavily on the sector’s performance.

Apartment REITs that previously traded at premiums to their net asset value (NAV) saw their valuations drop, with some trading at discounts pushing 40%. NAV, a key industry metric, represents the estimated market value of a REIT’s underlying real estate assets, minus its liabilities, typically on a per-unit or per-share basis.

As with most sudden shifts in sentiment, the negative outlook proved short-lived. Prime Minister Mark Carney’s commitment to moderate—not shut down—immigration growth along with reports suggesting Canada won’t achieve its reduced immigration target in 2025 have boosted sentiment. With prices rebounding and major acquisitions making headlines, it’s clear that investor perceptions toward apartment REITs have pivoted from caution to renewed confidence.

At Skyline, we’re doing our part with the recent purchase of 232 apartment suites in Windsor and two condo-style buildings totaling 48 suites in Mascouche, Quebec. These acquisitions bring our total national residential holdings to over 21,000 units².

Big institutional money comes calling for the second time since 2024

For the second time in seventeen months, major institutional capital has made an unsolicited bid to enter the space.

On January 19, 2024, Blackstone Inc.—the world’s largest alternative asset manager with over $1 trillion in AUM—agreed to acquire Tricon Residential Inc. in an all-cash deal valued at $3.5 billion, or US$11.25 per share. The move returned Blackstone to the single-family rental sector it helped pioneer over a decade ago following its 2019 exit from Invitation Homes.

The difference between then and now lies in the geographic location of the assets.

In 2024, the vast majority of Tricon’s portfolio was held in residential U.S. sunbelt markets, such as Arizona and Texas, while InterRent’s portfolio is exclusively located in Canada. While Blackstone and GIC both targeted Canadian REITs, institutional capital today is pursuing Canadian assets and market exposure—the very market Skyline has been serving investors in since 2003.

_______

It’s hard to look at GIC’s bid to acquire InterRent as anything other than a major endorsement for the sector. We believe it signals strong confidence in Canadian apartment REITs and will likely have positive ripple effects on sector valuations. The offer serves as a clear endorsement of the Canadian market—an industry that has faced recent challenges but continues to emerge with strong fundamentals.

Wayne Byrd, CPA, CMA

Chief Financial Officer,

Skyline

2Skyline Apartment REIT Annual Report, Skyline

_____________________

About Skyline

Skyline is a capital management company that acquires, develops, and manages real estate properties and renewable infrastructure assets, and offers them as private alternative investment products.

Skyline currently manages more than $9 billion* in assets across its real estate and renewable infrastructure platforms.

With approximately 1,000 employees across Canada, Skyline works to provide safe, clean, and comfortable places for tenants to call home, great places to do business, sustainable solutions for a greener future, and an engaging experience for its investors.

For more information about Skyline, please visit SkylineGroupOfCompanies.ca.

*As at March 31, 2025

For media inquiries, please contact:

Cindy BeverlyVice President, Marketing & Communications

Skyline

5 Douglas Street, Suite 301

Guelph, ON N1H 2S8

cbeverly@skylinegrp.ca